Why Smart People Make Terrible Financial Decisions (And How Business Owners Can Protect Themselves)

You’ve probably made a financial decision you were sure made sense at the time.

You ran the numbers.

You trusted your experience.

You felt confident.

And later, sometimes much later. you realized it wasn’t the smart move you thought it was.

This happens to intelligent, successful people more than anyone wants to admit.

Not because they’re careless.

Not because they lack discipline.

But because the human brain is wired in ways that make financial decision-making surprisingly fragile especially for business owners under pressure.

Understanding why smart people make bad financial decisions is one of the most valuable tools an entrepreneur can have.

Intelligence Does Not Protect You From Financial Mistakes

One of the biggest myths in business is that intelligence equals good decision-making.

It doesn’t.

Some of the worst financial decisions are made by people who are:

- highly educated

- experienced

- confident

- successful

- surrounded by opportunity

The problem isn’t intelligence.

The problem is psychology.

Your brain evolved for survival, not long-term financial optimization.

The Brain Is Wired for Speed, Certainty, and Comfort

Your brain prioritizes:

- quick decisions

- certainty over probability

- short-term relief

- consistency with past beliefs

These instincts helped humans survive.

They are terrible for:

- running a business

- managing cash flow

- evaluating risk

- paying yourself properly

- investing

- buying or selling companies

When money, ego, or pressure enters the picture, logic quietly steps aside.

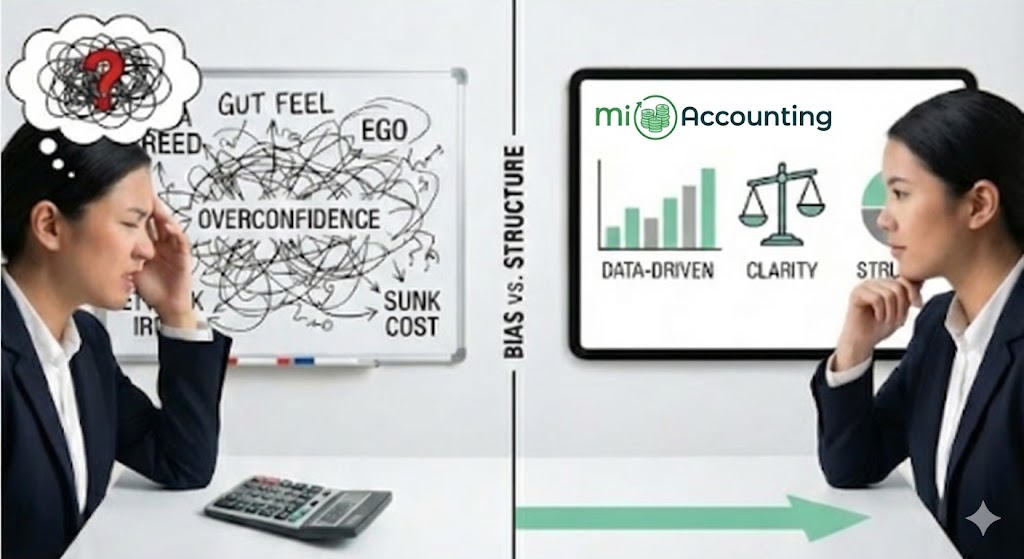

Overconfidence Bias “I Know What I’m Doing”

Overconfidence bias makes people believe:

- “I’ve been doing this for years”

- “I understand this business better than most”

- “I’ll figure it out as I go”

- “This feels right”

This is why business owners:

- skip proper analysis

- ignore downside scenarios

- dismiss professional advice

- rely on gut feel

- move too fast

Confidence feels productive.

But unchecked confidence is expensive.

Confirmation Bias Is Seeing Only What You Want to See

Once your brain decides something is a good idea, it actively filters information.

You:

- accept positive signals quickly

- rationalize red flags

- discount inconvenient facts

- trust voices that agree with you

This is how:

- weak cash flow is explained away

- tax risk is minimized

- messy books are ignored

- bad deals feel “almost right”

Your brain doesn’t want truth.

It wants reassurance.

H2: Sunk Cost Fallacy Is When Walking Away Feels Worse Than Losing

The more time, money, or emotion invested, the harder it becomes to stop.

Business owners think:

- “I’ve already put too much into this”

- “I can’t back out now”

- “It’ll work itself out”

This is how:

- bad investments continue

- unprofitable businesses linger

- stress compounds

- losses deepen

Walking away feels like failure.

Staying often costs far more.

Why Financial Decisions Feel Rational (Even When They Aren’t)

Most bad financial decisions don’t feel reckless.

They feel:

- justified

- logical

- supported

- reasonable

That’s because the brain is excellent at storytelling after the fact.

It builds narratives to protect ego and reduce discomfort.

This is why independent verification matters more than confidence.

The Real Role of Accounting Isn’t Compliance Is It’s Clarity

This is where accounting stops being paperwork and starts being protection.

Bad decisions thrive in:

- messy books

- late reporting

- incomplete data

- unclear cash flow

When bookkeeping is poor, business owners:

- guess

- assume

- react emotionally

- trust narratives instead of numbers

At MiAccounting, bookkeeping is not about filing returns.

It’s about producing decision-grade financials:

- accurate

- timely

- reconciled

- reliable

Clarity is the antidote to bias.

How Smart Bookkeeping Prevents Bad Decisions

When your numbers are clean and current, you can:

- see problems early

- identify margin erosion

- understand true cash flow

- separate profit from activity

- stop lying to yourself unintentionally

Good bookkeeping replaces:

- emotion with data

- assumptions with evidence

- hope with visibility

That alone prevents countless bad decisions.

Compensation Is Where Smart Owners Make the Worst Mistakes

Owner pay is one of the biggest emotional blind spots.

We regularly see business owners:

- overpay themselves and starve the business

- underpay themselves and burn out

- mix personal and business cash

- choose salary vs dividends poorly

- create tax inefficiencies without realizing it

These aren’t intelligence problems.

They’re emotional decisions made without structure.

At MiAccounting, we help business owners design smart compensation strategies based on:

- real cash flow

- tax efficiency

- sustainability

- long-term goals

This removes guilt, guesswork, and emotion from how owners get paid.

CFO Advisory Exists to Challenge Assumptions

The most valuable thing a CFO or advisor does isn’t math.

It’s friction.

Good advisory work:

- slows decisions down

- challenges optimism

- stress-tests assumptions

- forces uncomfortable questions

- separates growth from noise

Our fractional CFO services exist to ask questions like:

- Can the business afford this hire?

- What happens if revenue drops 10%?

- Is this growth profitable — or just busy?

- Are you making money, or just working harder?

Smart business owners don’t need cheerleaders.

They need people who will tell them the truth before it’s expensive.

Why “Gut Feel” Is Overrated in Business

People love saying:

“I trust my gut.”

Your gut is:

- emotional memory

- pattern recognition

- bias

- fear

- ego

Gut instinct can be useful in relationships and creativity.

In high-stakes financial decisions, it’s often the enemy.

Numbers don’t get defensive.

Cash flow doesn’t lie.

Verification doesn’t care about ego.

How Smart Business Owners Actually Protect Their Wealth

Smart business owners don’t avoid mistakes because they’re smarter.

They avoid mistakes because they:

- build systems

- rely on data

- separate emotion from decisions

- invite challenge

- slow down

- verify everything

- walk away when necessary

They assume they’re vulnerable — and plan accordingly.

Final Takeaway: Structure Beats Intelligence Every Time

Being smart does not protect you from:

- bias

- pressure

- optimism

- ego

- fear

Only structure does.

The most dangerous words in business are:

“I’m sure this makes sense.”

The safest ones are:

“Let’s verify this properly.”

How MiAccounting Helps Business Owners Make Better Decisions

MiAccounting exists to protect business owners from the most expensive risk of all their own blind spots.

We help by providing:

- accurate, timely bookkeeping that creates clarity

- tax planning that removes emotion from decisions

- smart compensation strategies aligned with cash flow

- CFO-level advisory that challenges assumptions

- valuation and risk analysis grounded in data

Whether you’re growing, restructuring, investing, or simply trying to make better decisions, we help replace gut feel with calm, defensible, informed judgment.

If you’re tired of guessing, reacting, or second-guessing yourself, it may be time for a different level of support.

👉 Book a conversation with MiAccounting.

We help business owners make smarter decisions — not by being smarter, but by building the structure that protects them.