Stop Scrambling at Year-End. Get Your Books Audit-Ready.

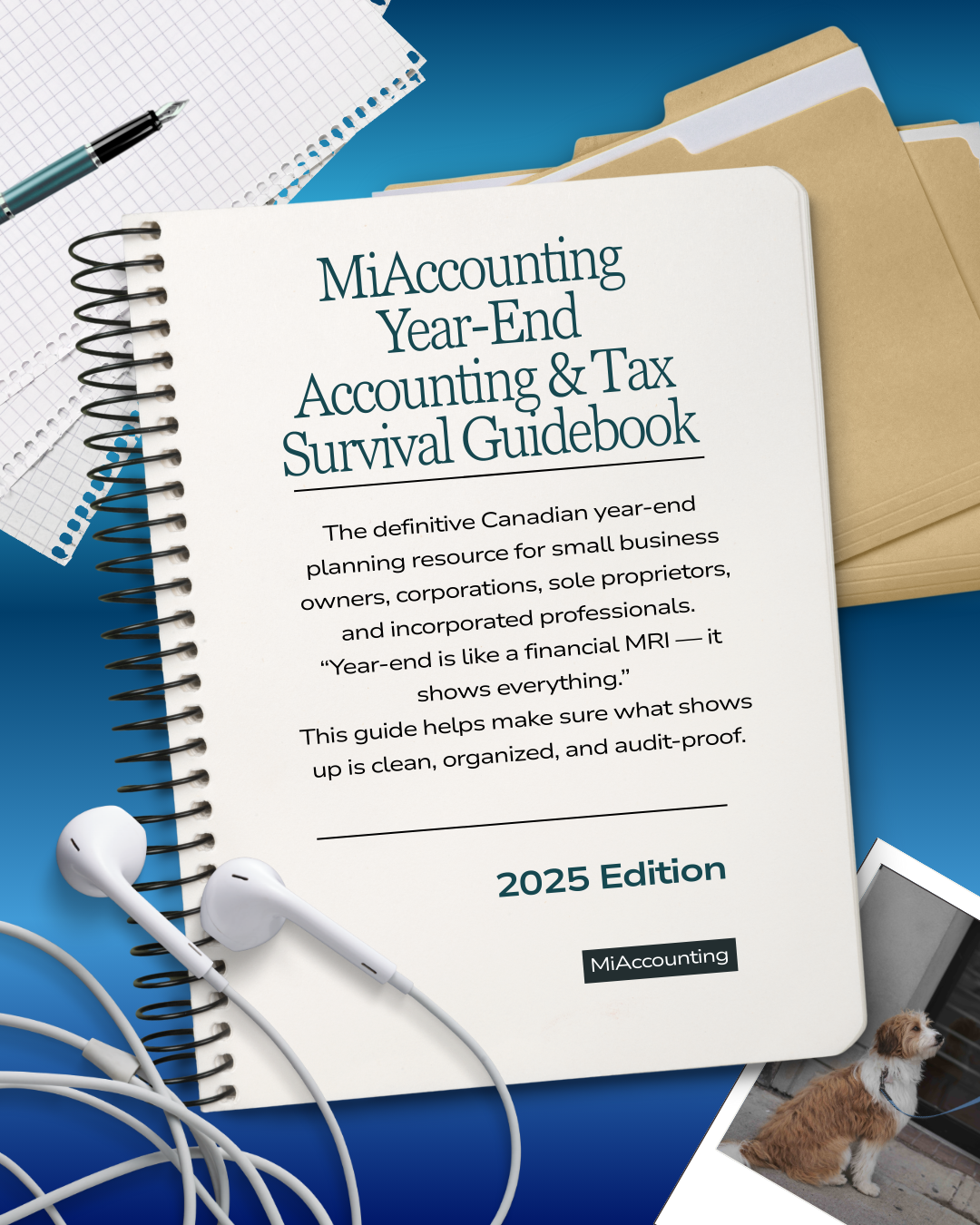

The essential Canadian year-end planning resource for small business owners, corporations, and incorporated professionals.

Turn year-end chaos into confidence

Year-end doesn't have to be stressful. This comprehensive guide walks you through everything from GST/HST compliance and salary vs. dividend strategies to CCA optimization and shareholder loan rules—all in plain language.

Whether you're a sole proprietor, incorporated professional, or small business owner, you'll get the exact checklists, timelines, and insider tips accountants use to keep their clients organized, compliant, and tax-efficient. Download it free and turn year-end chaos into confidence.

How you'll benefit from this guide

Maximize your tax deductions and avoid costly mistakes

Stay organized and CRA-compliant with step-by-step checklists

Insider strategies on salary vs. dividends, GST/HST, and more

Written in plain language by Canadian accountants for real business owners

Enter your email below to get instant access to your free guidebook.